The real estate mantra “location, location, location” has long been the cornerstone of wise real estate investment decisions. While there’s no definitive answer to the question of the “best” place to invest in rental properties, certain cities rise above the rest due to a combination of factors such as rapid population growth, economic expansion, and urban development. Charlotte, North Carolina, is one such city that has been gaining attention from real estate investors due to its impressive growth trajectory, thriving job market, and ongoing revitalization efforts. If you’re considering investing in rental properties, Charlotte is a city worth exploring.

Charlotte’s Rapid Population Growth: A Key Factor for Real Estate Rental Property Investment

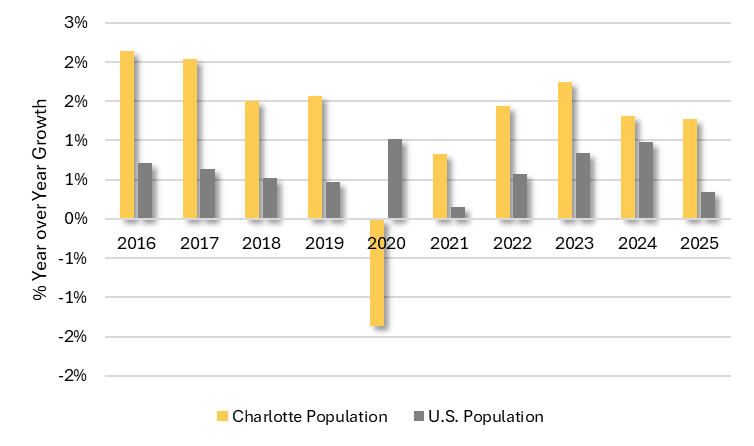

As of 2025, Charlotte’s population exceeds 920,000, placing it among the fastest-growing cities in the United States. Over the past decade, Charlotte has experienced a population increase of roughly 14%, and this upward trend shows no signs of slowing down, with a projected growth rate of around 1.3% annually. The city is attracting people from all over the country, with a notable influx from states like Virginia, New York, and California.

The rapid population growth is a crucial indicator for real estate investors, as it reflects the rising demand for housing in the area. As more people move to the city for jobs, education, and lifestyle opportunities, the need for both rental properties and long-term housing solutions grows. For investors, this surge in population is a clear signal that property values and rental rates are likely to appreciate over time.

Additionally, Charlotte’s younger demographic — with a significant portion of the population being Millennials and Gen Z — contributes to a strong rental market, particularly for apartments and townhomes. These groups tend to prioritize rental living over homeownership due to flexibility and convenience, making Charlotte an attractive city for rental property investors.

Note: Chart Shows Charlotte vs. U.S. % YoY Population Growth Since 2015

Charlotte’s Thriving Job Market: A Major Driver for Rental Demand

A robust job market is one of the primary drivers of real estate demand, and Charlotte’s job market is nothing short of dynamic. According to a study by CoworkingCafe, Charlotte ranks as one of the top 10 cities for recent college graduates, thanks to its low unemployment rate of just 3% — significantly lower than the national average of 4%. The city is home to numerous major employers, including Bank of America, Duke Energy, Belk, Lowe’s, Atrium Health, and Truist, which not only offer high-paying jobs but also attract a highly educated workforce.

Charlotte has earned the reputation of being the second-largest banking and financial center in the United States, behind only New York City. This designation, combined with the presence of other thriving sectors such as healthcare, technology, and energy, has made Charlotte a hub for job seekers. As a result, many newcomers flock to the city in search of employment opportunities, which in turn fuels the demand for rental properties.

With a high percentage of college graduates — approximately 43% of Charlotte residents hold a bachelor’s degree — the demand for quality rental housing among young professionals and educated individuals continues to rise. For real estate investors, this represents an ongoing opportunity to cater to a well-educated, high-income renter population.

Revitalization and New Developments in Charlotte: A Perfect Recipe for Rental Property Growth

One of the most compelling aspects of Charlotte’s appeal to real estate investors is the city’s continued urban development and revitalization. Areas that were once underdeveloped or overlooked have undergone significant transformations in recent years, with modern residential communities, mixed-use developments, and trendy retail spaces being built to accommodate the growing population.

Neighborhoods such as South End and NoDa (North Davidson) have become hotspots for young professionals and families, thanks to their rejuvenated infrastructure, new apartment complexes, and vibrant cultural scenes. These revitalized areas not only enhance the city’s aesthetic appeal but also increase the overall value of rental properties. As the city continues to expand, demand for housing in these newly developed and revitalized neighborhoods will only continue to grow, making them an attractive option for property investors.

Moreover, large-scale commercial developments — including office buildings, hotels, and entertainment venues — are also contributing to Charlotte’s transformation. These projects are likely to bring in more visitors and residents, further elevating the demand for housing. Real estate investors looking to capitalize on Charlotte’s long-term growth potential would be wise to keep a close eye on these areas as prime investment opportunities.

The Benefits of Investing in Tertiary Rent Markets Around Charlotte

While Charlotte itself offers strong real estate opportunities, surrounding areas or tertiary markets like Gastonia, Huntersville, Concord, and others offer even more attractive options for investors looking for affordable properties with substantial growth potential. These suburban markets provide a viable alternative to the more competitive and expensive Charlotte city center.

In contrast to Charlotte’s rapidly increasing property prices, the suburban markets surrounding the city tend to have relatively lower costs of entry. Investors can often find properties in these areas at a fraction of the price of those in Charlotte proper, which makes them an appealing choice for those looking to maximize cash flow and long-term returns on investment.

Furthermore, as more people move to Charlotte, many are seeking affordable housing options outside the city. The demand for rental properties in areas like Gastonia, Huntersville, and Concord has been steadily increasing, making these suburban markets ideal for investors looking for high rental yields. These areas also tend to have lower competition compared to Charlotte’s core markets, which gives investors a better chance of securing properties at competitive prices.

For example, Gastonia is located just 20 miles west of Charlotte, and it has been seeing significant growth in both residential and commercial real estate development. Similarly, Concord and Huntersville offer excellent transportation links to Charlotte, making them popular options for commuters. As the demand for suburban housing continues to rise, investors in these tertiary markets are well-positioned to see strong returns from rental properties.

Market Trends and Property Appreciation Potential

One of the key factors to consider when evaluating real estate investment opportunities is property appreciation potential. Charlotte’s strong economy, rapid population growth, and ongoing development point to continued property value increases over the next decade. Neighborhoods that were once overlooked are now emerging as desirable places to live, thanks to infrastructure investments, revitalization efforts, and access to amenities.

With its diverse economy and thriving job market, Charlotte is expected to see sustained growth in both rental income and property values. Areas experiencing revitalization or significant new developments are particularly likely to see property appreciation, which is an important consideration for long-term investors. Whether you are focused on short-term rental income or long-term capital gains, Charlotte offers numerous opportunities to grow your real estate portfolio.

Bottom Line

Charlotte stands out as a smart city for real estate investment due to its impressive population growth, thriving job market, and ongoing revitalization efforts. Whether you are considering investing in the city itself or in the growing suburban markets around Charlotte, there is a wealth of opportunities for rental property investors to explore.

The combination of an expanding workforce, strong demand for rental properties, and potential for property appreciation makes Charlotte a prime location for investment. Moreover, the affordability and low competition in the surrounding tertiary markets provide a unique opportunity for those looking for high cash flow and long-term growth. Whether you’re an experienced investor or just starting out, Charlotte offers a compelling case for real estate investment.

If you’re ready to tap into a thriving rental market, Charlotte and its surrounding areas should be at the top of your list.

Turn Edge Estates: Your Trusted Partner for Fast Cash Offers on Charlotte Properties

At Turn Edge Estates, we understand the dynamic Charlotte real estate market and the opportunities it presents for homeowners and investors alike. We specialize in making cash offers on local properties, providing you with a hassle-free way to sell your home fast, without the lengthy waiting periods or complex negotiations. As a locally-based business with deep knowledge of Charlotte’s market trends, we’re committed to delivering fair, fast, and reliable offers that meet your needs. Let us help you turn your property into cash today!