When it comes to housing decisions, many people find themselves torn between signing a rental lease or making a down payment on a property. This choice can be daunting, as the renting vs. buying debate is filled with complexities. Owning a home isn’t always the best option, and renting can be more than just a temporary solution. The right decision depends on individual circumstances, financial goals, and lifestyle preferences. This article explores the key considerations to help you make an informed choice between renting and buying real estate.

Key Takeaways: Renting vs. Buying Real Estate

- No down payment, closing costs, or property taxes, making renting a more affordable option initially.

- Rent payments contribute to the landlord’s equity, not the renter’s wealth.

- Mortgage payments contribute to building equity over time, and properties often appreciate in value.

- Renting allows you to invest savings in other areas, such as stocks or retirement accounts, potentially offering greater returns.

- Homeowners may qualify for tax deductions on mortgage interest, property taxes, or home repairs.

Renting and Investment Diversification: Why Some Choose to Rent

A common misconception about renting is that you’re simply throwing away money each month. In reality, renting is a necessary expense for many, just like any other form of housing. While renting doesn’t build equity, not all the costs of homeownership contribute to wealth-building either. For example, property taxes, maintenance, and mortgage interest may not offer the same long-term return as other investments.

Many financial experts suggest continuing to rent and investing excess savings in the stock market or other assets for potentially greater returns. However, it’s difficult to predict which investment—real estate or stocks—will yield a better outcome, given the various market forces and personal financial situations. When evaluating whether renting or buying is the right choice for you, it’s essential to consider lease terms and your long-term goals, which are discussed below.

The Growing Appeal of Month-to-Month Rental Leases in Urban Markets

Month-to-month rental leases have gained popularity, particularly in urban areas, as they offer tenants greater flexibility. Unlike traditional rental leases, which are often fixed for a set term, month-to-month rental leases continue indefinitely until either the tenant or landlord decides to end the agreement, typically with just a one-month notice. These rental leases appeal to young professionals and those with transient job situations who need the flexibility to relocate quickly without being tied down by a longer commitment.

Fixed-Term Rental Leases: A Predictable Option

Fixed-term rental leases are the most common type of rental agreement and generally last anywhere from six months to a year. These rental leases provide stability and predictability for both landlords and tenants. Renters benefit from knowing exactly how much they’ll pay for the duration of the lease, while landlords can rely on consistent rent payments for a set period.

Rent-to-Own Agreements: A Pathway to Homeownership for First-Time Buyers

Rent-to-own agreements can be an attractive option for first-time homebuyers who are not yet ready to make the leap to full homeownership. These rental lease agreements typically allow tenants to rent a property with the option to purchase it at the end of the lease. Additionally, a portion of the monthly rent payment is often credited toward the down payment, making it easier for renters to transition into ownership over time.

Sublet Clauses: A Flexible Option for Renters

Sublet clauses in rental lease agreements allow tenants to rent part or all of their living space to a third party, known as a subtenant. This can be an excellent option for renters who need to adjust their living situation due to personal or financial reasons. With the high cost of urban living, many tenants find subletting a practical way to offset rent costs by renting out a spare room or area. Subletting also provides flexibility, allowing renters to adjust their living arrangements without renegotiating their lease.

Pros of Renting

- Renting typically requires a smaller initial financial commitment, with no down payment, closing costs, or hefty maintenance expenses.

- Renters are not responsible for upkeep, repairs, or property taxes, which can significantly reduce financial stress.

- Fixed rent payments make budgeting easier and provide financial stability.

- Renting offers the freedom to relocate without being tied to a long-term commitment, making it ideal for those with uncertain job locations or personal plans.

- Renting allows you to free up savings to invest in other opportunities, such as the stock market or retirement accounts.

Cons of Renting

- Rent can increase over time, potentially making it less affordable in the long term.

- Landlords may decide to sell the property or choose not to renew the lease, forcing renters to move.

- Rent payments contribute to the landlord’s equity, not the renter’s, meaning you miss out on potential wealth accumulation through property ownership.

The Financial and Lifestyle Considerations of Buying a Home

Owning a home is often seen as a key way to build wealth, but like any investment, its potential benefits depend on several factors such as location, economic conditions, maintenance costs, and unforeseen events like natural disasters.

When you own a home, you typically build equity in two ways: through appreciation in the property’s value or by paying down your mortgage. While there’s no guarantee that any particular home will appreciate, real estate generally tends to increase in value over time. Equity refers to the difference between what you could sell your home for and what you still owe on the mortgage.

Each time you make a mortgage payment, part of it goes toward interest and part goes toward reducing the loan balance (the principal). These principal payments are often referred to as “forced savings” because they gradually build equity while you’re also securing a place to live—an expense you would have to pay regardless. Over time, a larger portion of your payment will go toward the principal, increasing your ownership in the home. This approach can be a particularly attractive option for those who prefer a more stable, long-term savings plan compared to stock market investments.

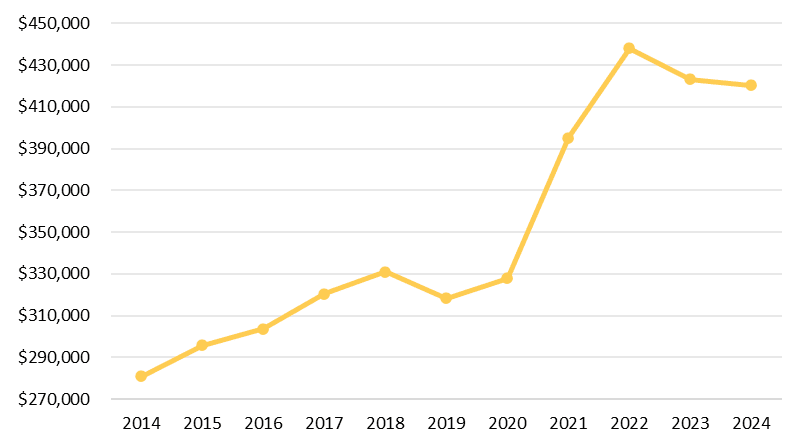

U.S. Median Sales Price of Houses Sold

Note: Chart shows Federal Reserve Bank of St. Louis’ U.S. Median Sales Price of Houses Sold for the United States from 2014-2024

Pros of Homeownership

- As you pay off your mortgage, you gradually increase your ownership stake in the property, potentially gaining a valuable asset.

- With a fixed-rate mortgage, homeowners benefit from predictable monthly payments and long-term stability.

- Homeownership gives you the freedom to make significant changes to your home, whether through renovations, landscaping, or interior design.

- Homeowners may qualify for various tax deductions, including mortgage interest, property taxes, and certain home-related expenses.

- Over time, many homes increase in value, which could lead to significant financial returns when it’s time to sell.

Cons of Homeownership

- Purchasing a home requires a significant initial investment, including a down payment, closing fees, and moving expenses.

- Homeowners are responsible for maintaining and repairing their property, which can be both time-consuming and costly.

- Homeowners must purchase insurance to protect their property, which can be expensive depending on the location and coverage needs.

- If the housing market declines, homeowners could face difficulty selling their property or recouping their investment.

The Bottom Line

The decision to rent or buy depends on your financial situation, lifestyle preferences, and long-term goals. Renting offers flexibility, lower upfront costs, and the opportunity to invest elsewhere, while buying a home can lead to equity building and long-term wealth accumulation. Both options have distinct advantages and challenges, ranging from maintenance responsibilities to market fluctuations.

To make an informed decision, consider using a rent vs. buy calculator to evaluate the financial implications of each option, taking into account monthly expenses, long-term costs, and potential returns. Ultimately, the best choice will depend on your unique circumstances but understanding both sides of the equation will help you make a decision that aligns with your priorities and financial objectives.

Turn Edge Estates: Your Partner in Real Estate Solutions

At Turn Edge Estates, we understand that real estate decisions can be overwhelming. Whether you’re looking to sell a property quickly or seeking cash offers for your home in Charlotte, we make the process simple and stress-free. Our team specializes in providing fair cash offers for properties, allowing homeowners to avoid the hassle of traditional real estate transactions. We aim to provide quick, efficient solutions tailored to your needs. Contact Turn Edge Estates today and see how we can help you move forward with a stress-free property sale.